NEW! Piano Inspires Podcast:

Tune in to listen to our inaugural interview series on the transformative power of music.

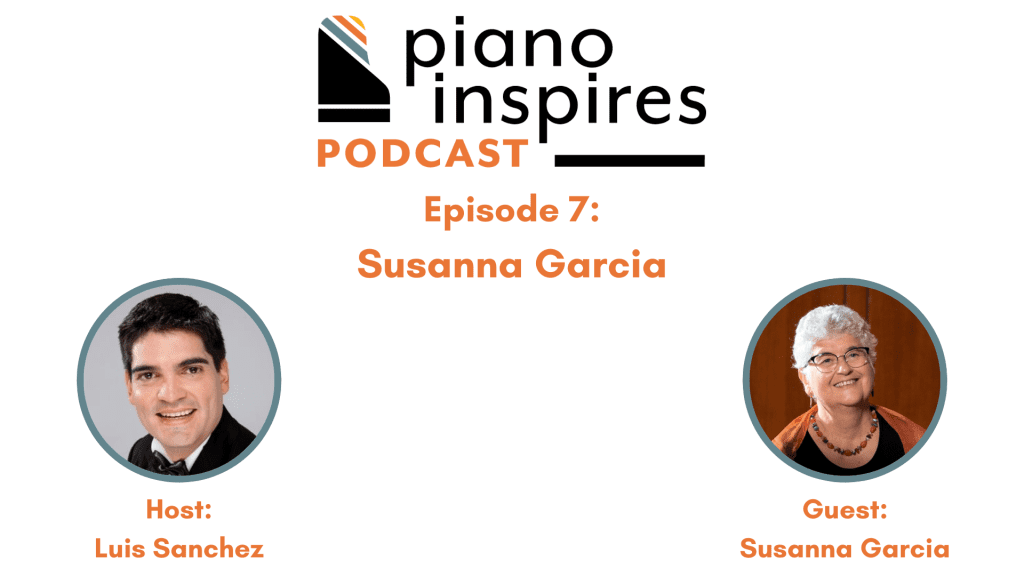

- Episode 7: Susanna Garcia Discusses DEIB with Luis Sanchez

- Episode 6: Connor Chee, Navajo Pianist and Composer

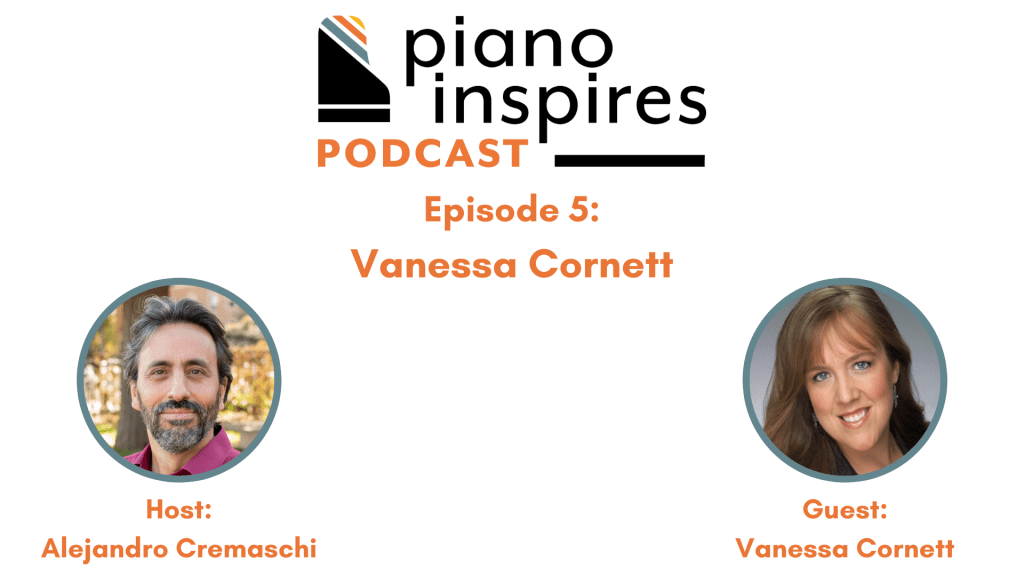

- Episode 5: Vanessa Cornett

NEW! Piano Inspires Discovery:

A space dedicated to inspiring the love of piano and music making through educational and inspirational content.

2024 Summer Intensive Seminars:

An International Exploration of Piano Teaching Literature

with Leah Claiborne and Luis Sanchez, Seminar Co-Leaders

Teaching Elementary Pianists

with Sara Ernst, Seminar Leader

Upcoming Events:

2024 Summer Intensive Seminars: An International Exploration of Piano Teaching Literature

with Leah Claiborne and Luis Sanchez, Seminar Co-Leaders

Mon Jul 8th

10:00am

Upcoming Webinars:

Foundations for Technique

with Julie Hague and Alejandro Cremaschi, host (04/17/2024)

Wed Apr 17th

11:00am

Pedagogical Approaches to Advancing Pianists Through Asian Repertoire

with Ross Salvosa, Regina Tanujaya, and Lisa Yui, with Leah Claiborne, host (05/01/2024)

Wed May 1st

11:00am